Open Fixed Deposit in SBI : State Bank of India is undoubtedly the best bank in India providing a lot of banking products for its customers. If you have saved a large amount of money, it is a good idea to get a SBI Fixed Deposit with that amount. In addition to the Fixed Deposit Amount, you will be getting a fixed interest from the Bank, depending upon the Amount and Period of Fixed Deposit. However, the interest will be taxable. When you open a Bank Account in SBI, you can open a fixed deposit as well. Even at a later stage if you are planning to open FD in SBI, you can get it. In this Article we will tell you the procedure to open fixed deposit in SBI. Don’t forget read one of our previous articles on how to get Credit Card against Fixed Deposit in SBI.

- Sbi Fixed Deposit Interest Rates

- Sbi Fixed Deposit Interest Rates 2020

- Sbi Fixed Deposit Rates For Senior Citizens

- Fixed Deposit Sbi Plan

Fixed Deposit is considered to be a safer investment option as compared to other investments like shares or the mutual funds. Opening a fixed deposit account in SBI is a quick and easy process. What you have to do is to just deposit money to open FD account for a given period of time and enjoy the interest.

Investing in a Fixed Deposit (FD) account does not come with any risks as they are not linked to the market. State Bank of India (SBI) offers several FD accounts at attractive interest rates. Singapore dollar deposits of non-bank depositors are insured by the Singapore Deposit Insurance Corporation, for up to S$75,000 in aggregate per depositor per Scheme member by law. Monies and deposits denominated in Singapore dollars under the CPF Investment Scheme and CPF Retirement Sum Scheme are aggregated and separately insured up to S.

In this Article, we will tell you how to :

- Open Fixed Deposit in SBI Online through Internet Banking

- Open Fixed Deposit in SBI by Branch Visit

How to Open a Fixed Deposit in SBI ?

Before we tell you the complete procedure to open Fixed Deposit in SBI, let us tell you what is a Fixed Deposit.

What is a Fixed Deposit ?

A specific deposit of money which pays higher interest as compared to a Savings Account. The customer needs to open a fixed deposit for a period of time. The period can be short term or long term. Depending upon the increase in the period, the bank offers a higher interest on the amount. Fixed Deposit is also known as term deposit.

Short-term Fixed Deposit Rates

SBI offers short-term deposits in which interest rates varies from 5.25% p.a. – 7.25% p.a. which is compounded quarterly. The term available are 30 days with 5.25 % ROI p.a, 60, 90 and 120 days with 6.5 % ROI p.a., 6 months with 6.75 ROI p.a, 9 months with 7.0 ROI p.a. The FD with a tenure of 1 yr earns an interest of 7.25% p.a.

Medium and Long-term Fixed Deposit Rates

SBI offers medium and long-term deposits in which interest rates varies from 7.0 % p.a. – 7.5 % p.a. which is compounded quarterly. The term available are 1.5 or 2 years with 7.0 % ROI p.a, and 3, 4 or 5 years with 7.5 % ROI p.a.

How to Open Fixed Deposit in SBI Online ?

In order to open a fixed deposit in SBI Online, you need to follow the step by step procedure given below :

1)Login to Online SBI Account using your Internet Banking Username and Password.

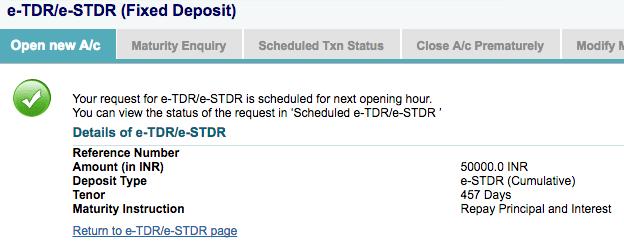

2) Select on the E-Fixed Deposit option on the Top Menu. Once you click on the E-Fixed Deposit Tab, you will reach another page.3) Select e-TDR / e-STDR (Fixed Deposit) radio button and click on Proceed.

4) Enter the Amount of which you want to open the Fixed Deposit & Scroll down.

Note : Senior Citizens must click on the box which says ‘Senior Citizen’. Kindly note that Senior Citizens get higher Interest Rates on fixed deposits of Rs.10,000 & above.

5) Select from the Term Deposit options (e-STDR/e-TDR)

- e-STDR (Interest Paid at Maturity)

- e-TDR (Interested Paid at Selected Intervals)

Once you select the Term Deposit option, tick mark on the box corresponding to ‘I Accept the terms and Conditions’ and click Submit button.

6) Soon after you click Submit button, your SBI Fixed Deposit Account will be opened.

Note : FD Account in SBI can be opened only between 8:00 am to 8:00 pm on all working days, otherwise it will be scheduled for next working day. Your SBI fixed deposit account will be mapped to the Net Banking account.

You will be notified at the time when your Fixed Deposit is going to mature. This is done so that you can take necessary action for it.

This is the complete process to open Fixed Deposit in SBI Online. Let us now know about the process to open SBI FD by Branch Visit.

Also Read :

How to Open Fixed Deposit in SBI by Branch Visit ?

In order to open a fixed deposit in SBI by Branch Visit, you need to follow the step by step procedure given below :

1) Visit the SBI Branch in which you want to open your Fixed Deposit Account.

2) Collect the SBI Fixed Deposit Account Opening Form from the Accounts Executive.

3) Fill up the fixed Deposit Form carefully, re-check the filled up form and put your signature wherever needed.

4) Submit the self attested Copy of your Address Proof and PAN Card along with theFD Form to the Accounts Executive.

5) Once your FD Form and Documents are verified, you will need to deposit the FD Amount through the Cash Deposit Window.

6) Finally, your SBI Fixed Deposit Account will be opened and you will be given your FD Account Number and related documents(if any).

This is the complete process to open Fixed Deposit in SBI by visiting SBI Branch.

Final Words :

You might have noticed that opening a FD in SBI is quite an easy process and does not take much time. Although both online and offline processes are simple, but it all depends upon your convenience which one you want to use. If you have Internet Banking Account in SBI, you can easily open a Fixed Deposit in SBI in not more than 4-5 minutes. At any point of time you also have the option to close Fixed Deposit in SBI.

READ ALSO :

e-TDR/e-STDR FAQ

1. Can I open a Term deposit account through Internet banking?

Yes, if you have Internet banking user name and password, and at least one transaction account mapped to the username.

2. What is the minimum tenure for an online deposit?

As a general rule the minimum tenure for a term deposit is 7 days and the maximum is 10 years. However Both TDR and STDR are bound by the following minimum and maximum tenures. Minimum tenure is 7 days for TDR and

180 days for STDR and Maximum tenure is 3650 days for TDR and STDR.

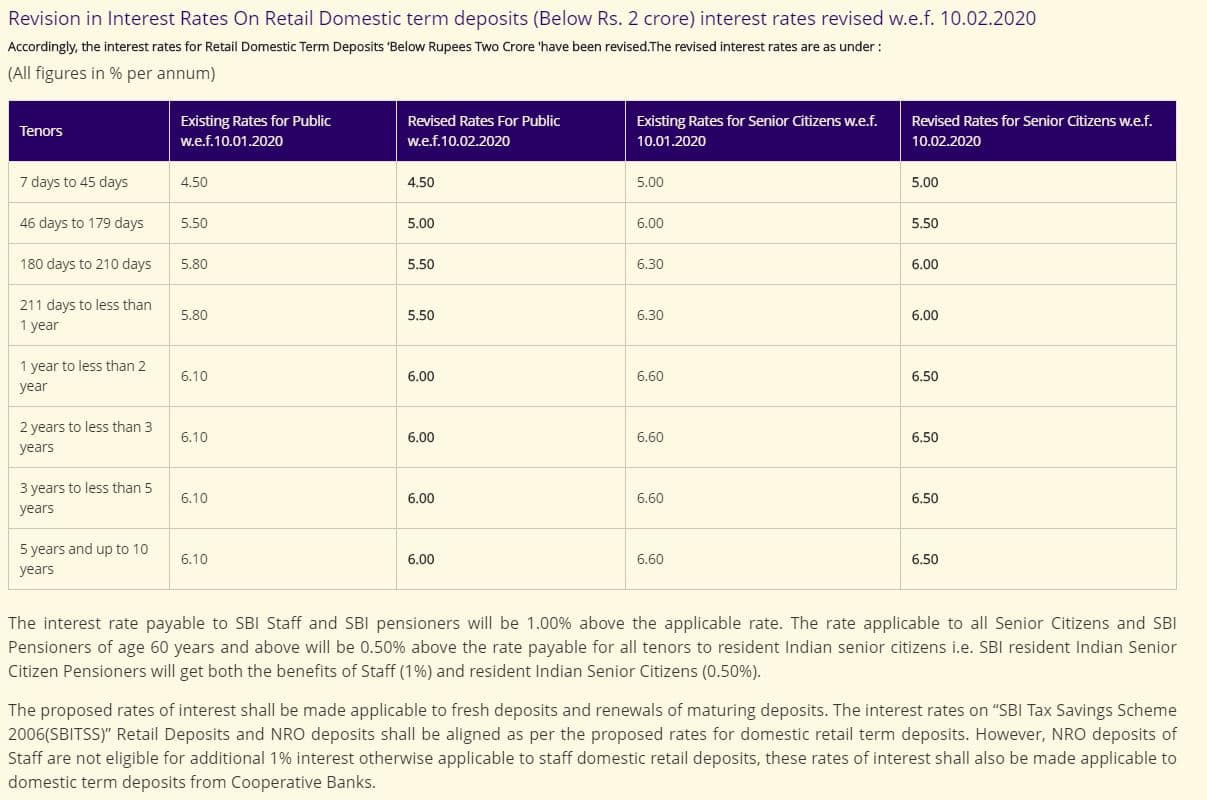

3. What are the interest rates for a term deposit?

The interest rates vary from time to time. You can view the latest interest rates by clicking on 'View current interest rate' link provided in e-TDR/e-STDR request page.

4. What is the minimum amount for a term deposit?

You can open a term deposit with a nominal amount of Rs.1000/- , however minimum & maximum amount limit may vary for different product codes.

5. Can I generate a term deposit advice?

Yes, you can generate and print a term deposit advice containing all your relevant details.

6. In whose name will the term deposit account be opened? What is the mode of operation?

The name(s) and mode of operation and branch of newly generated deposit a/c will be same as in debit a/c, from which term deposit a/c is funded.

7. How is the maturity amount calculated? Can I make enquiry before opening e-TDR/e-STDR?

The maturity amount is based on the tenor& type of a/c selected by customer. You may enquire the maturity amount, maturity date and rate of interest, without opening e-TDR/e-STDR through 'Enquiry' tab available in e-TDR/e-STDR page.

8. What are the types of accounts from which I can debit an amount for the deposit?

You can debit a savings, current, or OD account to open term deposit. The account selected for debiting should be valid transactional a/c through Internet Banking channel and should not be a stopped / dormant / locked account.

9. How can I renew or pre-mature my deposit a/c.?

The Special term deposit a/c will be automatically renewed at the time of maturity if you do not approach Branch for payment / renewal on maturity. For prematurity of deposit a/c you may use 'close a/c' tab under e-TDR/e-STDR link. The maturity proceeds will automatically transfer your debit a/c from which e-TDR/e-STDR was originally funded at the time of opening.

Sbi Fixed Deposit Interest Rates

10. Can I close my e-TDR/e-STDR instantly through 'close a/c' tab?

Yes, you may close your e-TDR/e-STDR instantly if request is initiated between 08:00 AM IST to 08:00 PM IST. Request initiated beyond this period will be scheduled for next opening hours ie 08:00 AM IST.

11. Can I close TDR/STDR opened at the branch?

No, Only e-TDR/e-STDR can be closed through 'close a/c' tab. TDR/STDR opened at branch can be closed at branch only.

12. Can I open online term deposit a/c for any other name(s), not belonging to debit a/c from which term deposit a/c is funded.

13. Can I transfer the maturity money to any of my accounts?

No, maturity amount or the amount payable before maturity will be transferred only to the debit account from which it was funded.

14. Can senior citizen avail additional rate of interest on term deposit?

Yes, Senior citizen can also avail additional rate of interest in e-TDR/e-STDR. The date of birth in Bank's record will be considered for age calculation. The minimum days and minimum amount applicable for additional rate of interest for senior citizen will be as per Bank's policy. In case of joint accounts, the Senior Citizen benefit can be availed only if the first account holder qualifies for this benefit.

15. What is the validity of advice automatically generated through SBI online banking system?

The advice is equally valid as provided by branch. Internet Banking customers are advised to take printout of term deposit advice after generation of deposit a/c. However if presented at the Branch for payment, Branch will verify all the details shown in advice before proceeding further.

16. How can I add nominees in Term Deposit a/c?

Sbi Fixed Deposit Interest Rates 2020

While opening an e-TDR/e-STDR, you will be provided with an option to retain the nominee(s) for term deposit a/c as in debit a/c from which it is funded

Sbi Fixed Deposit Rates For Senior Citizens

17. Can I add a new nominee online?

No, you will have to visit your branch for adding a new nominee.

18. Is there any cut off time for creating e-TDR/e-STDR online?

Yes. e-TDR / e-STDR can be created online from 8:00 AM IST to 8:00 PM IST. Requests initiated beyond this period will be scheduled for the next opening hours.

19. Can I open fixed deposit for tax exemption under Sec 80C of Income Tax Act?

Fixed Deposit Sbi Plan

Yes, for this you have to choose the option 'e-TDR / e-STDR under Income Tax Saving Scheme'.