The question is inclusive and pertains to both minors (below 18 years of age) and their guardians. Someone who is less than 18 years old but can read and write can open the term deposit account on his/her name. Whereas, minors who can’t read and write will have their guardians on the term deposit account. Now coming to the exact question, let us tell you can open a fixed deposit account at some banks shown below. Let’s read the features of minor term deposit accounts of such banks and figure out the one which is the best of all.

Table of Contents

Fixed Deposit Accounting

- 1 List of Banks Offering Minor FD Account

- 2 Documents Required to Open a Minor Fixed Deposit Account

Fixed Deposit Account

J$100 NCB START (up to 17 years of age) J$2,000 NCB Regular Save; J$5,000 NCB Gold Club (age 55 and over) J$5,000 NCB Chequing Account; J$10,000 NCB Sunshine Savers. Open your account with JA$25,000. Tax-free interest on your five-year savings. Competitive interest rates. Withdraw up to 75% of your interest every 90 days. Certificate of deposit. Online banking using JN LIVE. 10% discount on JAA membership fee.

List of Banks Offering Minor FD Account

Bank of Baroda Minor Fixed Deposit Account

Bank of Baroda, one of the largest private sector banks in India, has two fixed deposit accounts for minors –

- Someone with more than 10 years of age (Who can read and write)

- Someone with less than 10 years of age

The first one will be opened in the sole name of minors. On the other hand, the second one will open on a joint basis with natural guardians being the joint account holders. For fixed deposit accounts where a minor is 14 years old or less, the maximum amount accepted is 1,00,000. If the age of a minor is more than 14 years, there shall be no maximum limit. The rate of interest will apply as per the prevailing card rates.

PNB Balika Shiksha Fixed Deposit Scheme

As the name suggests, the said fixed deposit is available for girl students belonging to Scheduled Caste or Scheduled Tribe. All those girls who pass standard eighth from Kasturba Gandhi Balika Vidyalaya and enroll for class IX in schools sponsored by states, union territories or any local bodies in the academic year 2008-09 onwards. The government of India allows a deposit of INR 3,000 for the girl child. Withdrawal is allowed only when the girl becomes 18 years old.

HDFC Bank Kids Advantage Account

It’s actually a savings account that comes with the MoneyMaximizer facility. So once the balance of the account goes past 25,000, the excess amount will sweep out to the fixed deposit account, hence raising the interest earnings.

Fixed Deposit Account Nepal

Canara Bank Minor Fixed Deposit Account

Canara Bank allows fixed deposit accounts for minors with their guardians as the joint holders. The minimum deposit allowed is INR 1,000 and there’s no maximum limit. You can choose the deposit period from as short as 7 days to as long as 10 years. The interest rate will apply as per the prevailing card rate.

Features Of Fixed Deposit Account

Bank of India Minor Fixed Deposits

Bank of India also allows minors to open a fixed deposit account and earn interest on the same. The account will open only when the guardians of minors become joint account holders. The minimum deposit amount is INR 5,000 for accounts opened in rural and semi-urban branches. In case the deposit account is opened in metro and urban branches, the minimum amount should be INR 10,000.

Documents Required to Open a Minor Fixed Deposit Account

- Birth certificate of the minor child

- PAN Card mandatory for guardians who are joint holders of a minor fixed deposit account

- Voter ID/Driving License/Passport/Aadhaar Card for identity proof (Applicable to Minor Guardians)

- Voter ID/Driving License/Passport/Aadhaar Card for address proof (Applicable to Minor Guardians)

Fixed Deposit Account Definition

Goal Account

Get closer to your Chama goals with the highest-earning savings account in Kenya. Lock your savings for periods between 6 months and 5 years while being able to borrow up to 100% of those savings in loans. The Goal Account also offers great flexibility, allowing you to open multiple accounts to help you pursue all your dreams.

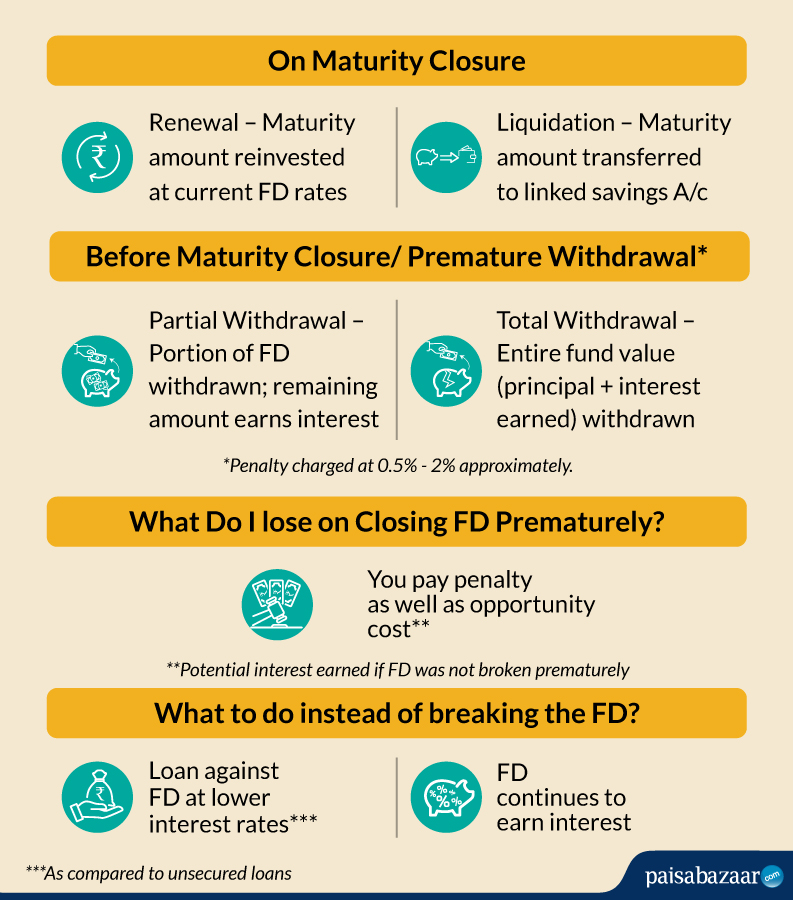

Fixed Deposits

Grow your money with our Fixed Deposit account. Our competitive interest rate of up to 6% p.a. on your savings will have you reach your goal faster. The interest applies to local and foreign currencies; and will only be accrued if the money remains in the account for the agreed tenor.

Dual Currency Deposits

Dual option currency deposits provide a fixed rate of interest above that which is paid out by traditional money market investments.

The tenure of these deposits’ range from one to three months, during which no capital protection is offered.

Treasury Bills & Bonds

Looking for a stable and risk-free way to grow your money? Treasury Bills and Bonds are a surefire investment that can be a stable source of income.

KCB Capital in Treasury Bills and Bonds on your behalf.

Call Deposits

Sign up for Call Deposit; an interest-bearing investment account that allows you to withdraw your money from the account without a penalty, at a moment’s notice.

Enjoy the various benefits, such as withdrawing from your account without prior notification to the bank.

Custody Services

Our custody services are designed for all our customers from retail customer, high net-worth individuals, and corporates looking to diversify their investment portfolio both in the local and international money market funds.

We will hold in custody on your behalf funds, securities, financial instruments or documents of title to the assets of an investment portfolio.

Our core customer services include; settlement of investment transactions, capital and income collection (e.g. dividends, Interest income), corporate actions processing, proxy voting services, compliance monitoring, activity reporting, corporate trustee services, central depository agency services and safekeeping of securities