Taking advantage of the mobile check deposit feature at your bank can be a big time saver. Although it may take some getting used to, the time you save will be well worth the short learning curve.

- You can find how and when we issued your first and second Economic Impact Payments using Get My Payment. As of January 29, 2021, Get My Payment will no longer be updated for the first and second Economic Impact Payments.

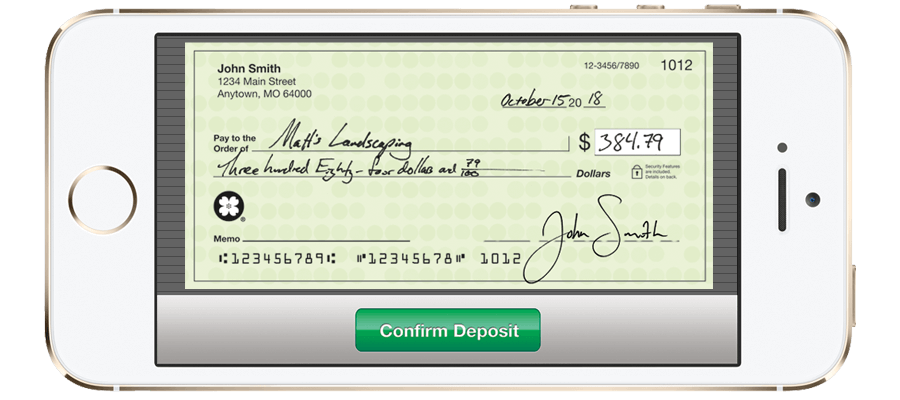

- Sign your check. Open the app and tap Deposit in the quick-action menu at the bottom of the Welcome screen, then Deposit a check.; Choose an account and enter the amount of the check. Take pictures of the check with your phone or tablet. Verify the information and submit.

- In the Chase Mobile ® app, choose “Deposit Checks” in the navigation menu and select the account. Enter the amount of the check and tap 'Front'. With our 'Auto Capture' feature, the picture of the front and back of the endorsed check will be captured — or you can choose to take the pictures manually.

If you're worried about visiting a bank to cash a check during the ongoing pandemic, we've got a collection of mobile banking tips to help you figure out banking from home.

COVID-19 continues to spread globally with over 6,500 cases confirmed in the U.S. As the country begins closing non-essential businesses to curb the spread, many politicians have floated the idea of sending out stimulus checks to help ease financial burden of those affected by the coronavirus outbreak.

If a physical check goes out, it's reasonable to assume you'd need to go to the bank or retail location to cash it. Therein lies the problem — if you're supposed to limit non-essential travel, how do you get your check cashed?

Fortunately, we live in an era where you can deposit a check from the comfort of your home. And, if you already have a bank account with a major U.S. bank, you'll probably just need to download your bank's app to do so.

If you haven't signed up for online banking but are able to do so from home, you may want to do this on a desktop computer. Using a desktop computer will ensure that you can avoid any of the usual pitfalls that come with creating an account on a mobile device. Some banks still require you to set up any online banking services either in person or via the phone, so be sure to check your individual bank's requirements.

Once you're signed up for online banking through your bank, download the banking app. It's always a good idea to directly visit your bank's website and follow their direct link to their app.

Most national and regional bank chains, such as Wells Fargo and Bank of America, allow for mobile check depositing through their apps. Even some smaller banks are getting in on the practice, so it definitely behooves users to peruse their bank's mobile apps.

If you have a bank but they don't offer mobile check depositing, Paypal is a great option. Paypal allows you to cash a check via their mobile app and transfer the funds to your bank account provided you've linked the two.

If you don't have a bank account, you're not out of luck, either. Banks like Ally, Capital One, and Charles Schwab allow users to sign up for free online banking. They also offer online check depositing and will send you a debit card within a week or two of being approved.

Opening a bank account is not something that should be taken lightly, and AppleInsider suggests you do your due diligence by researching what banks are going to work best for you.'

Deposit Check By Phone

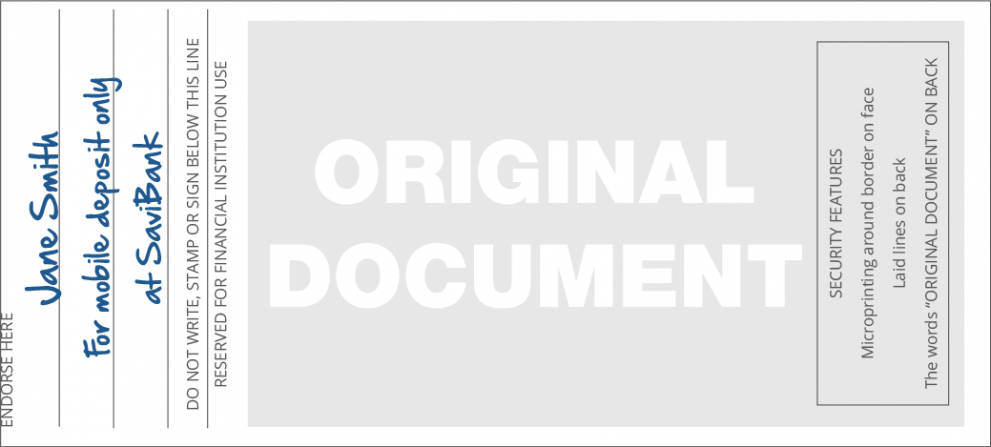

- Confirm how you'll need to endorse your checks. Many banks will require you to write 'for mobile deposit only' under your signature when you endorse the check. If you do not follow the instructions exactly, the check has a higher chance of being rejected.

- Work in a well lit area. You'll likely need to turn on both an overhead light and a table lamp to avoid casting any shadows directly on the check while photographing it. Some banks also suggest putting a check on a contrasting background, such as a wooden table.

- Do not use the flash on your phone. Flash leads to image blowout, which makes the information hard for the bank to confirm.

- Line up the check exactly as the app tells you. Try to avoid getting a skewed image by holding your phone horizontally when taking the picture.

- Double check your work. Most mobile banking apps allow you to review the images you've taken. Can you clearly make out all the information on the check? If you can't, chances are, the app won't be able to, either.

- Check your email and push notifications. Most banks have a fairly fast turnaround for mobile deposits, and will alert you within an hour if the check has been accepted or denied.

- If the check is denied, you can try to take two new images and redeposit it. If it is denied a second time, you may need to call your bank or visit the branch in person.

- If the check is accepted, it's generally considered a good practice to hold onto it for 14 days. Afterward, you'll want to destroy the check.

AppleInsider has affiliate partnerships and may earn commission on products purchased through affiliate links. These partnerships do not influence our editorial content.

Deposit Check Online

How it works:

Deposit Checks Online

Process all types of U.S. checks, drawn on any bank or credit union that is a Federal Reserve member, including personal checks, business checks, government checks and warrants, money orders and traveler's checks over the Internet. Using check truncation, the paper checks never leave your office and, in fact, should be destroyed after the successful deposit of funds into your bank.

The use of electronic check conversion - also known as Check 21, Accounts Receivable Check (ARC), Point of Purchase (POP), or Back Office Conversion (BOC) in banking terms - is among the fastest growing types of ACH applications due to its enormous benefits. Using our proprietary Internet-based Back office conversion 'Remote Deposit Capture' software and check scanning reader, you can scan conventional paper checks and transform them into an electronic check deposit. The software also stores the check data and check images in a database for future research and retrieval, re-submission of NSF checks and more.

Cash App Mobile Check Deposit

You accept many checks each month from customers. Currently, you would have to look up each customer account, apply the payment to the account, stamp the check for deposit, create a deposit slip, drive to the bank, stand in a long line and make the deposit. On top of this, your bank will typically charge an 'item deposit fee' for every check you deposit. Too time consuming and too expensive!