Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities. UponArriving has partnered with CardRatings for our coverage of credit card products. UponArriving and CardRatings may receive a commission from card issuers.

- Chase Bank Savings Account Interest Rates

- Interest Rate On Chase Bank Savings Account

- Current Chase Bank Savings Account Interest Rate

- Chase Bank Savings Account Interest Rate

The Chase Savings account is best for those who can maintain a minimum $300 balance to avoid the monthly fee. Chase’s biggest draw is its $150 welcome offer and Automatic Savings Program, which lets you set up recurring transfers from your Chase checking account. But the interest rate for this account is only 0.01%, which is almost nonexistent. Chase Bank does not offer a money market account. Some of the banks with the best money market accounts currently available include BBVA, with a $10,000 minimum deposit for a 1.50% APY interest rate.

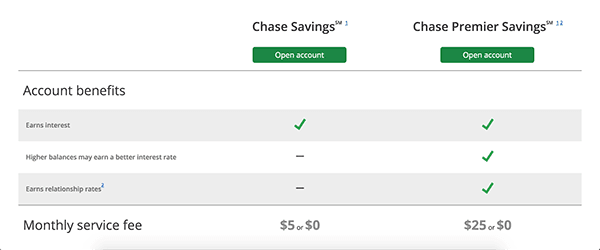

There are two main types of Chase savings account for the average consumer: Chase Savings and Chase Premier Savings. Below, I will go into detail about each of these accounts. I will show you all of the fees and how to avoid those fees and also give you some insight into the interest rates you can expect with a Chase savings account. And finally, I will also talk to you about the different types of bonuses you can get with these accounts and how valuable those can be.

Depending on the type of Chase account you open, you might have to pay $5 to $25 to keep your account open although there are several ways to get the fee waived.

Chase Savings fee & minimum daily balance

The monthly service fee for a Chase Savings account is five dollars but you can get this waived if:

- You have a balance at the beginning of each day of $300 or more in the account

- You have at least one repeating automatic transfer of $25 or more from your personal Chase checking account or Chase Liquid Card

- You are an account owner who is younger than 18

- You have a linked Chase personal checking account (excluding Chase High School Checking, Chase College Checking, Chase Secure Checking, Chase Total Checking, and Chase Checking)

Chase Premier Savings fee & minimum daily balance

The monthly service fee for a Chase Savings account is $25 but you can get this waived if:

- You have a balance at the beginning of each day of $15,000 or more in this account or you’re linked with Chase Premier Plus Checking or Chase Sapphire Checking.

Both accounts are subject to the $5 savings withdrawal limit fee. This applies to each withdrawal or transfer out of the account over six per monthly statement. However for the Chase Premier Savings this fee is waived if you have a balance of $15,000 or more in the account at the time of the transfer out.

Federal regulations (“Regulation D” to §204.2(d)(2)) restricts you to only six savings account withdrawals or transfers per monthly statement (this limit does not apply to withdrawals or transfers that are made in person at a branch office or at an ATM).

If you happen to exceed the federal limitations then Chase may convert your savings account into a checking account (a Chase Total Checking Account). They likely would only do this if it happen multiple times.

The big question a lot of people have with Chase savings accounts is what kind of interest rates you get. If you are hoping for industry leading yields for your savings accounts you will not find those with Chase.

Also, the interest rate that you get will depend on the type of account you open up and potentially how much money you keep in the account.

Below, I will show the interest rates as of April 2019 for my area of Texas but keep in mind that these can change in the future and based on your geographic location (although they often apply nationwide).

Chase Savings interest rates

The Chase Savings interest rate for all balances is .01%. This is not an impressive annual percentage yield and you can do much better than this with other savings accounts.

It is not that difficult to find savings accounts that offer 2% or more for the annual percentage yield. And some of those accounts don’t even require you to make any deposit or a large deposit. Therefore, if you are looking for one of the best APYs then this is not the account for you.

However, you also need to keep in mind the value that you can get from special bonuses offered when you open up an account and meet certain requirements. Keep reading below to see how lucrative these bonuses can be and what types of requirements that you need to meet.

Chase Premier Savings interest rates

The interest rates for the Chase Premier Savings accounts depend on the amount in your account. Here are the rates that I found:

$0-$9999

.04%

$10,000-$24,999

.04%

$25,000-$49,999

.04%

Chase Bank Savings Account Interest Rates

$50,000-$99,999

.07%

$100,000-$249,999

.07%

$250,000-$499,999

.09%

$500,000-$999,999

.09%

$1 million-$4,999,999

.09%

$5 million-$9,999,999

.09

$10,000,000+

.09%

Once again keep in mind that this was only a snapshot of the interest rates and that these could fluctuate depending on where you live and the time of checking.

If you open up a Chase savings account you also get the following benefits:

- Mobile check deposit

- Banker guidance

- Text banking

- Real-time fraud monitoring

- Paperless statements

If you are interested in a banking solution that has more substantive perks you might look into Chase Private Client or Sapphire banking.

If you would like you can open a Chase savings account online. To do so simply click here to get the process started.

It should not take very long for you to set up your account. If you are already a Chase customer you can sign in and the process will be faster since they already have some of your information.

You will need to provide some of your personal details such as your name and some of your identification information such as your citizenship, date of birth, social security number, and ID number (your drivers license works).

You will also need to provide your home address and your email address along with your phone number. If you are opening up a Chase joint savings account then be sure to have all of their information with you as well.

I highly recommend that you wait to sign up for a Chase Savings Account until you can jump on a special bonus and get a lot of free money. Click here for the latest bonus. If you sign-up right away the coupon code is automatically applied. Otherwise, you can have the coupon code emailed to you.

Note: if there is no branch in your state you may have issues proceeding with the enrollment online.

These special bonuses come in different forms but a lot of times they will look like the following.

Checking bonuses

There will often be a designated bonus for opening up a checking account. These bonuses can differ but it’s not uncommon to see a $200 to $300 bonus for opening up an account and doing some kind of action like setting up direct deposit.

Savings bonuses

For the Chase savings account bonuses you may be looking at something like a $200 bonus after opening up an account and performing certain actions. For example, you may have 20 days to deposit $15,000 in cash and then you will need to maintain that for 90 days in order to get the bonus.

Packaged bonuses

Then there are also bonuses that are a package deal. This allows you to capitalize on these earnings by opening up both a personal checking account and a personal savings account. When you meet the requirements above you might be given a sweet deal like a $600 bonus.

Once you have met the requirements you can expect to receive funds within 10 business days.

You can receive only one new checking and one new savings account opening related bonus every two years from the last enrollment date and only one bonus per account. There are usually deadlines for the special bonuses but they tend to be extended very often. So you don’t necessarily always have to be in a rush to open up these accounts.

The bonuses are considered interest so your earnings may be reported to the IRS.

These offers are typically not available to current customers. For example the terms and conditions usually state:

Checking offer is not available to existing Chase checking customers. Savings offer is not available to existing Chase savings customers.

Also if your accounts have been closed within 90 days or you have a negative balance you will not be eligible.

Am I automatically approved?

You will not be automatically approved for a Chase savings or checking account. It is not that difficult to get approved for one of these accounts but if you have very bad banking history with negative balances and a lot of closed accounts for example that could count against you.

Will there be a hard pull on my credit?

Whenever you open up a Chase savings account there will not to be a hard pull on your credit report. Therefore your credit score should not be impacted whatsoever by applying for an account.

How to close a Chase savings account

You cannot close your accounts online with an easy click. Instead, you can call the Chase customer service phone number 1(800) 935-9935 (representatives available 24 hours a day, 7 days a week).

You can also visit an in-branch office to close your savings account. Click here to search for Chase branches near you and be aware that many might not be open on Sunday. (You can use the filter feature to find banks open on Sunday.)

If you want to try to handle things online you can send a secured message and try that route though that’s not the quickest route to go.

Also, you can mail in your request with snail mail if you’d like as well. If you want to do that you’ll need to fill out this form and send it to the following address:

National Bank By Mail

P O Box 36520

Louisville, KY 40233-6520

Deliveries by Overnight or Certified Mail:

National Bank By Mail

Mail Code KY1-0900

416 West Jefferson, Floor L1

Louisville, KY, 40202-3202, United States

Is there a Chase savings account for college students?

Interest Rate On Chase Bank Savings Account

I’m not aware of a Chase savings account for college students but they do have a Chase checking account for college students for college students 17 to 24 years old at account opening with proof of student status.

Current Chase Bank Savings Account Interest Rate

They also have checking accounts for high school students too (for students 13 to 17 years old at account opening with their parent/guardian as a co-owner and the account must be linked to the parent/guardian’s personal checking account). So if you’ve got kids 13 or older, you might look into this option for them.

Chase Bank Savings Account Interest Rate

Note: When the student turns 19, the Chase High School Checking account will become a Chase Total Checking account.

Is there a Chase health savings account?

Yes, the Chase Health Savings Account (HSA) is a special, tax-advantaged account you can use to pay for qualified medical expenses if you have a High Deductible Health Plan (HDHP) and meet all other eligibility requirements. You can find out more about it here.

Chase does not offer the best annual percentage yield for your savings account. In fact, it is very easy to find much more lucrative rates by shopping around with a quick search. The good news is that you can often jump on these bonus promotions where you can earn a lot of free money up front if you can meet certain requirements. In those situations, these savings accounts and checking accounts can actually be quite lucrative.

UponArriving has partnered with CardRatings for our coverage of credit card products. UponArriving and CardRatings may receive a commission from card issuers. Responses are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all posts and/or questions are answered.

Daniel Gillaspia is the Founder of UponArriving.com and creator of the credit card app, WalletFlo. He is a former attorney turned full-time credit card rewards/travel expert and has earned and redeemed millions of miles to travel the globe. Since 2014, his content has been featured in major publications such as National Geographic, Smithsonian Magazine, Forbes, CNBC, US News, and Business Insider. Find his full bio here.

Related

Please turn on JavaScript in your browser

It appears your web browser is not using JavaScript. Without it, some pages won't work properly. Please adjust the settings in your browser to make sure JavaScript is turned on.

Chase Savings℠

Open accountChase Savings℠ Interest Rates

Interest is compounded and credited monthly, based on the daily collected balance. Interest rates are variable and determined daily at Chase's discretion. Rates are effective for 03/05/2021 only, and are subject to change without notice. Web site rates are generally updated each business day in the morning and rates may vary by market. Balance tiers are applicable as of the effective date of these rates and may change at Chase's discretion. Rates may vary by market. Account fees could reduce your earnings.

Chase Savings℠

Open accountChase Savings℠ Interest Rates

Interest is compounded and credited monthly, based on the daily collected balance. Interest rates are variable and determined daily at Chase's discretion. Rates are effective for 03/05/2021 only, and are subject to change without notice. Web site rates are generally updated each business day in the morning and rates may vary by market. Balance tiers are applicable as of the effective date of these rates and may change at Chase's discretion. Rates may vary by market. Account fees could reduce your earnings.