Information on BOQ 1 Year Term Deposit Rates: Banks throughout Australia including BOQ or Bank of Queensland when determining various interest rates for their deposit products factor in a few different aspects that affect the overall rate they set. Term Investments. If you have more than $5000 to lock away, talk to us. We can help out with a number of different terms and great interest rates. At the end of the term, you’ll have full access to both the principal and the interest you’ve earned. Then you can re-invest or not, it’s up to you. Compare BOQ Deposit rates Account Name Rate; BOQ 6 Month Term Deposit: 1.90%: BOQ 4 Year Term Deposit: 1.80%: BOQ 1 Year Term Deposit: 1.75%: Compare 3 month rates in Australia. Account Name Rate; Bank of China Australia 3 Month Term Deposit: 2.40%: St George Bank 3 Month Term Deposit.

Boq Term Deposit Rates Calculator

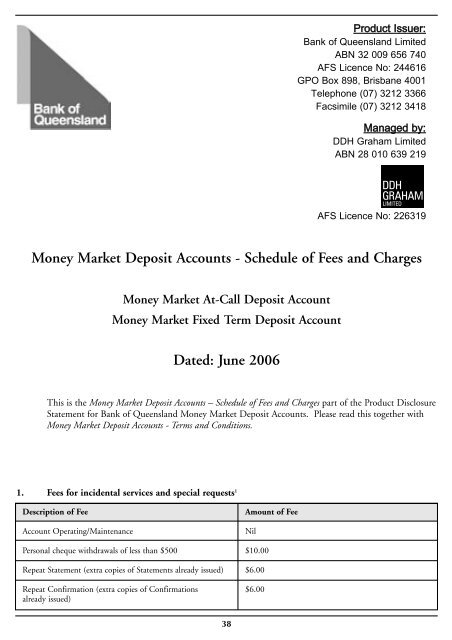

What are BOQ Money Market Deposit Accounts?

The Account is an individual bank account with BOQ that is managed, administered and distributed via licensed professionals exclusively by DDH Graham Limited (DDH).

Full terms and conditions are available at any BOQ branch. Interest rates quoted are indicative only, and are subject to change without notice. ^Comparison rates calculated on the basis of a secured loan of $150,000 for a term of 25 years. WARNING: This comparison rate is true only for the examples given and may not include all fees and charges. Term deposit interest rates are subject to frequent market change. To view the most current AMP Bank business term deposit rates, it’s best to view the provider’s website directly. If you want to earn competitive rates on your fixed deposits for an amount between $100,000 and $500,000, AMP Bank deposit may worth considering.

Boq Business Term Deposit Rates

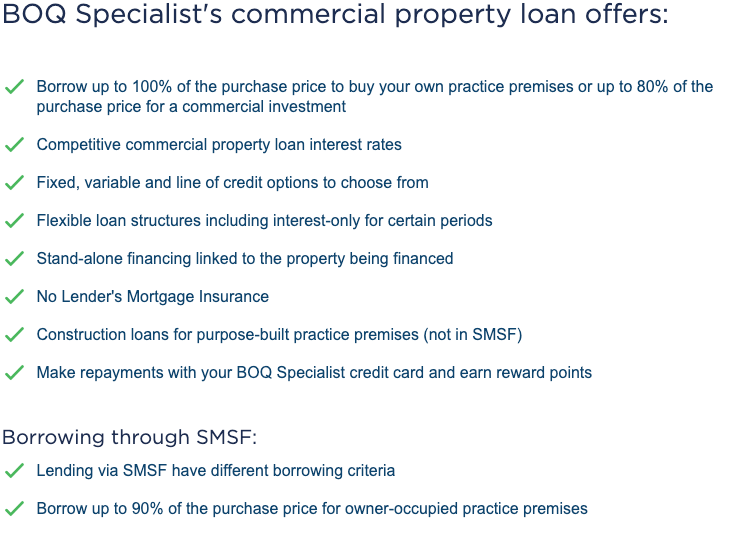

Boq Specialist Term Deposit Rates

BOQ Money Market Deposit Accounts are available to a full range of investors (including self managed superannuation funds) and provide the option of two different deposit facilities which offer an attractive rate of return. Consolidating your cash into a central facility provides a comprehensive view of your cash position.